Fca Registration Money Laundering Regulations

The idea of money laundering is very important to be understood for these working within the financial sector. It is a course of by which dirty money is transformed into clean cash. The sources of the money in precise are criminal and the money is invested in a manner that makes it appear like clean money and conceal the id of the legal part of the cash earned.

While executing the financial transactions and establishing relationship with the brand new customers or sustaining current prospects the obligation of adopting sufficient measures lie on every one who is a part of the organization. The identification of such component to start with is straightforward to take care of as an alternative realizing and encountering such conditions later on in the transaction stage. The central bank in any country gives complete guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously present sufficient safety to the banks to discourage such situations.

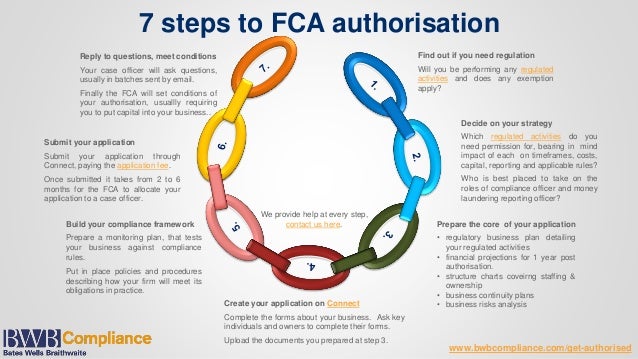

FCA supervision and enforcement. 1Regulation 102 of the Money Laundering Regulations provides the FCA with the power to charge fees to persons registered with the FCA under the Money Laundering Regulations 6 to recover the cost of carrying out its functions under those regulations.

Crypto License Uk Fca Crypto Registration Best Explained Psp Lab

The FCA is advising customers of cryptoasset firms which should have applied to the FCA but have not done so to withdraw their cryptoassets or money before 10 January 2021.

Fca registration money laundering regulations. Youre responsible for all the activities and anti-money laundering compliance of any premises or agents that are listed under your Money Laundering Regulations registration. The UKs Financial Conduct Authority FCA warned that a massive number of crypto businesses are failing to meet UK requirements for the prevention of money laundering activities. Following a joint investigation by the Financial Conduct Authority and City of London Police the FCA has charged Simon Day with one offence of money laundering contrary to Section 3271 of the Proceeds of Crime Act.

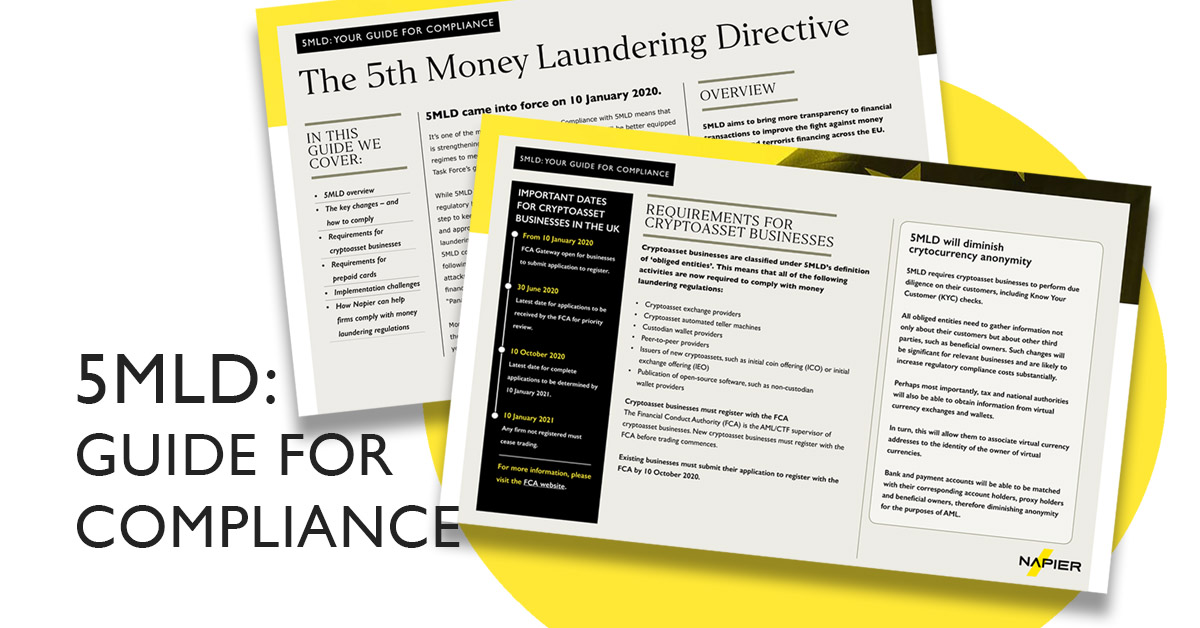

Since 10 January 2020 existing businesses operating before 10 January 2020 carrying on cryptoasset activity in the UK have needed to be compliant with the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 as amended and need to be registered with the FCA. The Money Laundering Regulations give the FCA responsibility for supervising the anti-money laundering controls of Annex I financial institutions a reference to Annex I to the Capital Requirements Directive where they are listed. Indeed in early 2020 the FCA set up a new registration authorisation for cryptocurrency companies.

From this date existing cryptoasset businesses ie firms operating immediately before 10 January 2020 have had to comply with the Money Laundering Regulations. The Financial Conduct Authority FCA has established a Temporary Registration Regime to allow existing cryptoasset firms who have applied to be registered with the FCA to continue trading. The purpose of this Appendix is to set out the charges relating to persons registered with the FCA under the Money Laundering Regulations.

In practice this includes businesses that offer finance leases commercial lenders and providers of safe deposit boxes. The Financial Conduct Authority the FCA make these directions in the exercise of the powers set out in regulation 74A of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692. The FCA charges a fee for registration forms submitted to it.

Under the rules of the authorization cryptocurrency companies were required to apply for the right to continue their operations by January 9th 2021. CRYPTOASSET BUSINESSES REGISTERED UNDER THE MONEY LAUNDERING REGULATIONS Powers exercised A. In May 2021 the FCA notified us that it had started an investigation into our compliance with the Money Laundering Regulations 2017 potential breaches of some of the FCA Principles for.

The FCA also charges6 an annual periodic fee. The deadline was then extended to July of 2021 and then again to March of 2022. Businesses carrying out certain cryptoasset activities also need to comply with the MLRs in relation to those activities from 10 January 2020 and to register with us during 2020.

Money Laundering Regulations. Such firms were required to be registered with the FCA by 10 January 2021. This is set out in Regulations 8 and 9 of the MLRs.

Individuals and businesses have to register with us for anti-money laundering and counter terrorist financing purposes if they are carrying on cryptoasset activities within scope of the MLRs and if this activity is in the course of business carried on in the United Kingdom. These regulations require you to apply risk-based customer due diligence measures and take other steps to prevent your services from being used for money laundering or terrorist financing. This regime brought cryptoassets into scope in January 2020 and is mandatory for.

Mr Day is due to appear at Westminster Magistrates Court on. On Thursday June 3 the FCA announced that it had extended the deadline for the so-called Temporary Registration regime from July 9 2021 to March 31 2022. Zodias registration with the FCA means the business is now supervised under the Money Laundering Terrorist Financing and Transfer of Funds Regulations 2017.

The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 119. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 SI 2017692 Money Laundering Regulations 2017 or MLRs 2017 form part of the UKs anti-money laundering AML and counter-terrorist financing CTF regime. Since January 10 2020 Any crypto exchange operating in the UK must register with the FCA under anti-money laundering rules.

1The FCA has investigation and sanctioning powers in relation to both criminal and civil breaches of the Money Laundering RegulationsThe Money Laundering Regulations impose requirements including amongst other things obligations to apply customer due diligence measures and conduct ongoing monitoring of business relationships on designated types of business. Money Laundering Regulations 2017.

Fca Money Laundering Registration Form Fcms And Ibs Must File Form Sar To Report Suspicious Transactions That Are Conducted Or Attempted By At Or Through The Firm And Involve An

Fca Raises Money Laundering Concerns With Cryptoasset Firms Ftadviser Com

Uk S Fca Extends Temporary Registration Regime For Crypto Businesses

Crypto License Uk Fca Crypto Registration Best Explained Psp Lab

Application Form For Banks Financial Conduct Authority

Fca Money Laundering Registration Form Fcms And Ibs Must File Form Sar To Report Suspicious Transactions That Are Conducted Or Attempted By At Or Through The Firm And Involve An

Fca Money Laundering Registration Form Fcms And Ibs Must File Form Sar To Report Suspicious Transactions That Are Conducted Or Attempted By At Or Through The Firm And Involve An

Fca Extends Crypto Company Registration Deadline After Mass Aml Failures Sygna

Fca Warns Crypto Businesses Fail To Meet Uk S Money Laundering Regulations Standard Atf News

Introduction To The Financial Conduct Authority Money Laundering In The Uk Tookitaki Tookitaki

Fca Money Laundering Registration Form Fcms And Ibs Must File Form Sar To Report Suspicious Transactions That Are Conducted Or Attempted By At Or Through The Firm And Involve An

Anti Money Laundering In The Uk Who Regulates Me

Crypto License Uk Fca Crypto Registration Best Explained Psp Lab

The world of regulations can appear to be a bowl of alphabet soup at instances. US cash laundering rules are not any exception. We've compiled a listing of the top ten cash laundering acronyms and their definitions. TMP Threat is consulting agency targeted on protecting monetary providers by decreasing risk, fraud and losses. We've got big financial institution expertise in operational and regulatory danger. We have a powerful background in program management, regulatory and operational threat in addition to Lean Six Sigma and Business Process Outsourcing.

Thus cash laundering brings many adversarial penalties to the organization due to the dangers it presents. It will increase the likelihood of major dangers and the opportunity value of the bank and ultimately causes the bank to face losses.

Komentar

Posting Komentar