First Stage Of Anti Money Laundering

The concept of money laundering is essential to be understood for those working within the financial sector. It's a course of by which soiled money is converted into clean money. The sources of the money in precise are prison and the money is invested in a manner that makes it appear like clear cash and hide the id of the prison part of the money earned.

While executing the financial transactions and establishing relationship with the brand new prospects or sustaining current clients the responsibility of adopting adequate measures lie on each one who is a part of the organization. The identification of such element at first is easy to take care of as an alternative realizing and encountering such conditions later on within the transaction stage. The central bank in any nation gives full guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously provide sufficient security to the banks to discourage such situations.

Second phase involves mixing the funds. The 1989 creation of the Financial Action Task Force FATF which identifies and.

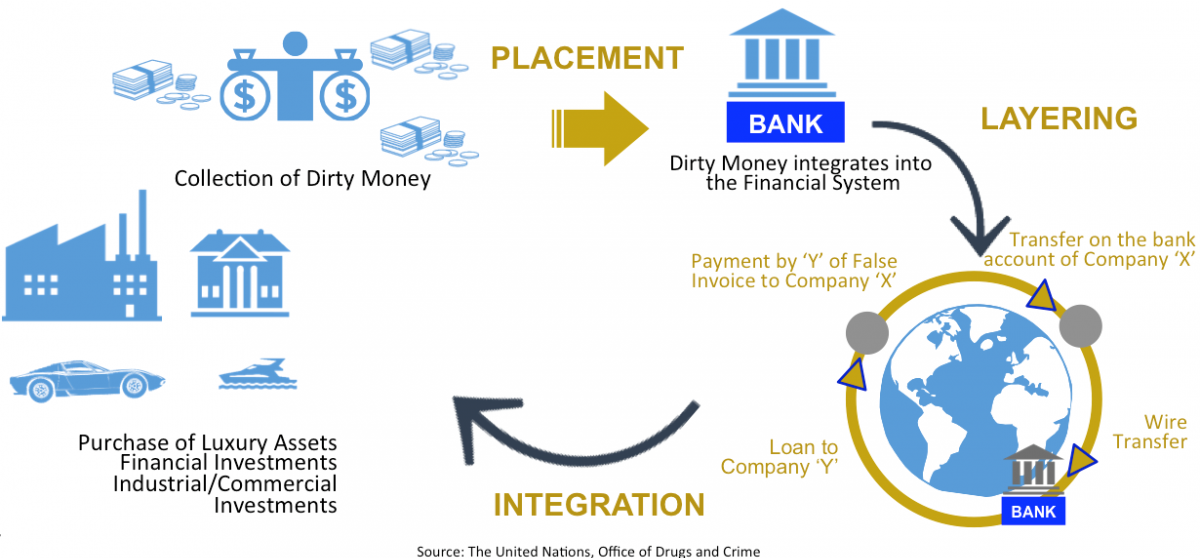

Placement is the very first step of the 3 stages of money laundering which includes moving the money into legitimate source like- casinos financial institutes financial instruments etc also hiding the source of money.

First stage of anti money laundering. At this stage the dirty money that has come from illegal activities is entered into a legitimate financial system. Anti- Money Laundering customer onboarding is the first stage that points to a connection between a client and a monetary institution. Often but not in every case in.

The initial stage of money laundering Placement occurs when the launderer introduces their illegal profits into the financial system. An example of placement can be placing the funds in a bank account to begin the cleaning process. The acceleration of money laundering and terrorist funding in the late 20th century led to one of the US.

The first anti-money laundering structures came about with the Financial Action Task Force FATF. This stage is termed as placement. Placement layering and integration.

Criminals may use several methodologies to place illegal money in the legitimate financial system including. This might be done by taking a large amounts of money and dividing it into less obvious sums. There are usually two or three phases to the laundering.

There are 3 stages of money laundering. Money laundering is often comprised of a number of stages including. The placement stage represents the initial entry of the dirty cash or proceeds of crime into the financial system.

The first stage of money laundering is known as placement whereby dirty money is placed into the legal financial systems. 1 placement 2 layering and 3 integration. It ensures that international standards are put in place to prevent money laundering.

Such criminals need to place the cash into the financial system usually through the use of bank accounts in order to commence the laundering process. Money laundering activity may also be concentrated geographically according to the stage the laundered funds have reached. There are many ways of money laundering which are explained in the articles linked at the end of this post.

Since the 2001 terrorist attacks the FATF now also includes terrorist surveillance in an. It is important to mix the funds from illegal sources with legalIt is relatively very difficult to detect money laundering at this stage. A criminal organization holds cash in bulk.

Funneling illegal funds through legitimate businesses that deal heavily in cash transactions. However it is important to remember that money laundering is a single process. Placement is the first step of money laundering which is the process of moving the money into the legitimate source via financial institutions casinos financial instruments etc.

This is the first stage in the washing cycle. Placement The first stage of money laundering is when the individual participating in criminal activity places cash proceeds into the financial system. Placement layering and integration.

Money laundering has one purpose. First the illegitimate funds are furtively introduced into. This is done so that they can get rid of the cash that is derived from criminal sources.

Governments earliest attempts at global anti-money laundering. Although the specific techniques used to clean dirty money vary financial experts cite three stages of money laundering in the process. Placement This is the movement of cash from its source.

There are three stages involved in money laundering. Here are some of the most common ways this is achieved. Placement is the first stage of money laundering.

Accordingly the first stage of the money laundering process is known as placement. In the first stage money enters the banking system. At the placement stage for example the funds are usually processed relatively close to the under-lying activity.

The stages of money laundering include the. Stage 1 of Money Laundering. To turn the proceeds of crime into cash or property that looks legitimate and can be used without suspicion.

These are called methods of laundering. After getting hold of illegally acquired funds through theft bribery and corruption financial criminals move the cash from its source. During onboarding a business collects as much client data as likely in order to understand their client or for CDD purposes.

History of Anti-Money Laundering Laws Money laundering is the process of making illegally-gained proceeds ie. The money laundering cycle can be broken down into three distinct stages. Typically it involves three steps.

Dirty money appear legal ie. And at the same time hiding its source.

What Is Money Laundering Tookitaki Tookitaki

Understanding Money Laundering European Institute Of Management And Finance

What Is Anti Money Laundering Quora

The Stages Of Money Laundering Dimension Grc

Layering Aml Anti Money Laundering

What Are The Three Stages Of The Money Laundering Process The Best Time To Stop Money Laundering Is At The Placement Stage

First Stage Of Money Laundering Placement People Launder Money Using Money Laundering Techniques For Two Principal Reasons

Paul Renner C6 Intelligence What Is Money Laundering

Money Laundering Stages Methods Study Com

What Are The Three Stages Of Money Laundering

Understanding Money Laundering European Institute Of Management And Finance

3 Stages Of Money Laundering Techniques Anti Money Laundering

Anti Money Laundering Overview Process And History

Three Stages Of Money Laundering Download Scientific Diagram

The world of laws can appear to be a bowl of alphabet soup at times. US money laundering rules are no exception. We have compiled an inventory of the highest ten money laundering acronyms and their definitions. TMP Threat is consulting agency focused on protecting monetary services by lowering danger, fraud and losses. Now we have big financial institution experience in operational and regulatory danger. We've got a robust background in program administration, regulatory and operational threat in addition to Lean Six Sigma and Enterprise Course of Outsourcing.

Thus cash laundering brings many opposed consequences to the group as a result of risks it presents. It increases the likelihood of main risks and the opportunity cost of the financial institution and finally causes the financial institution to face losses.

Komentar

Posting Komentar